salt tax limit repeal

A group of Democrats from high-tax states like New Jersey and New York has been pushing for months to include a full repeal of the Trump-era limit on state and local tax deductions as part of. To change the deduction limit for state and local taxes.

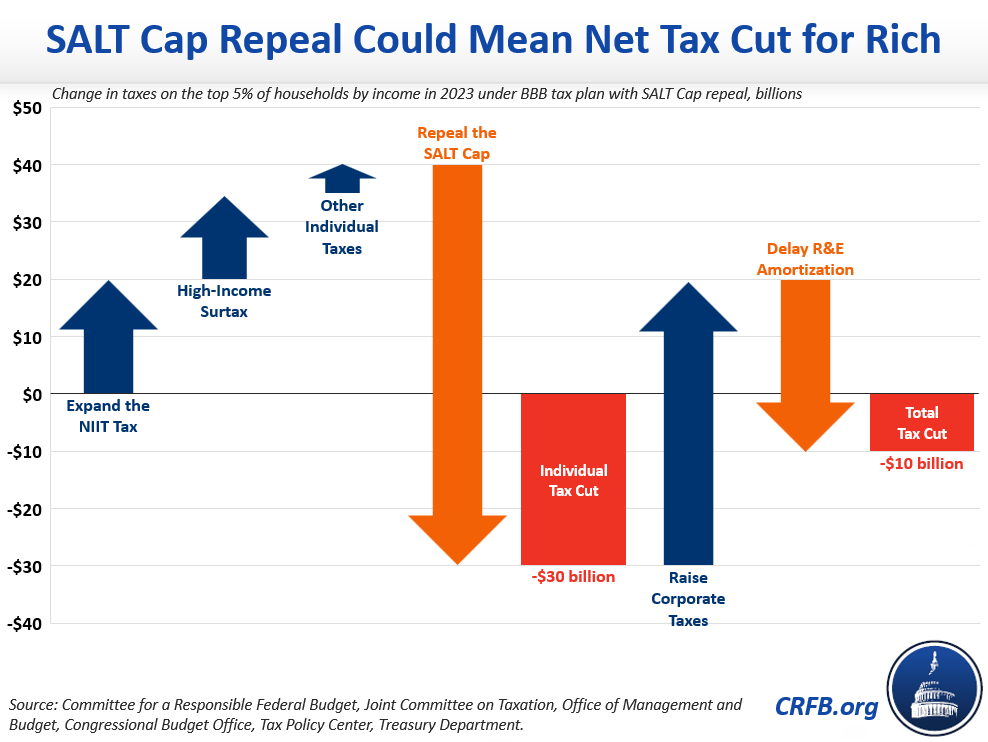

Reconciliation May Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

The 10000 cap would in theory resume in 2024 and 2025.

. The elective tax does not have an expiration date concurrent with the sunset of the federal SALT cap. Most people do not qualify to itemize. The Tax Foundation estimates a full repeal of the SALT deduction limit may reduce federal revenue by 380 billion through 2025 when the provision will sunset.

The 10000 SALT cap has become a bargaining chip in the Democrats 175 trillion spending plan among certain lawmakers from high. Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure. However the bill stalled in December.

Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of 7 percent of taxable income for tax years beginning on. As adopted under the Tax Cuts and Jobs Act the cap is set to expire at the end of 2025. California Passes SALT Cap Work-Around.

11 rows The TCJA also repealed the Pease limitation for tax years 2018 through 2025. The early repeal of the NOL suspension and business credit limits comes amid strong tax revenues and a 457 billion budget surplus. After more than two hours of debate on Thursday the House of Representatives passed a bill to temporarily repeal the 10000 annual limit.

The period to opt-in to the New York PTET has ended for tax year 2021 but for tax years 2022 and later an eligible entity may opt in on or after Jan. Americans who rely on the state and local tax SALT deduction at tax time may be in luck. Under the 2017 Tax Cuts and Jobs Act TCJA the cap expires at the.

A Democratic proposal aims. 1 but no later than March 15 of the tax yearie by March 15 2022 for the 2022 tax year. SALT Repeal Just Below 1 Million is Still Costly and Regressive Dec 11 2021 Taxes To avoid cutting taxes for households making over 1 million some politicians have suggested eliminating the State and Local Tax SALT deduction cap for households making below 900000 or 950000 per year.

While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break for the wealthy. The SALT cap has been debated by federal policy makers since its adoption. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

Given the social objectives of the Build Back Better Act and its corresponding revenue-raising requirements attempts to expand the SALT deduction limit look distinctly out of place. Meanwhile a growing number of states. Advocates on one side continue to push for repeal and advocates on the other side push for extension into 2026 and beyond.

Many Democrats from high-tax states have. While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step. SALT Agreement Near as Lawmakers Eye Two-Year Repeal of Limit by Laura Davison 92821 A key Democratic lawmaker said a detailed final agreement to restore the federal deduction for state and local taxes could be reached this week with another advocate flagging a temporary repeal of the breaks limit as the likely proposal.

Key Points House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The plan reportedly would repeal the SALT cap for 2022 and 2023 only. The change may be significant for filers who itemize deductions in.

11 rows As President Bidens tax plans are considered in Congress the future of the 10000 cap for state. July 29 2021. Heres how Democrats plans affect Americans with big state and local tax bills.

Finally the TCJA. The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments The maximum SALT deduction is 10000 but there was no cap before 2018 You must itemize using Schedule A to claim the SALT deduction. House Democrats in November passed a spending package boosting the SALT cap to 80000 from 2021 through 2030 before reinstating the 10000 limit in 2031.

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

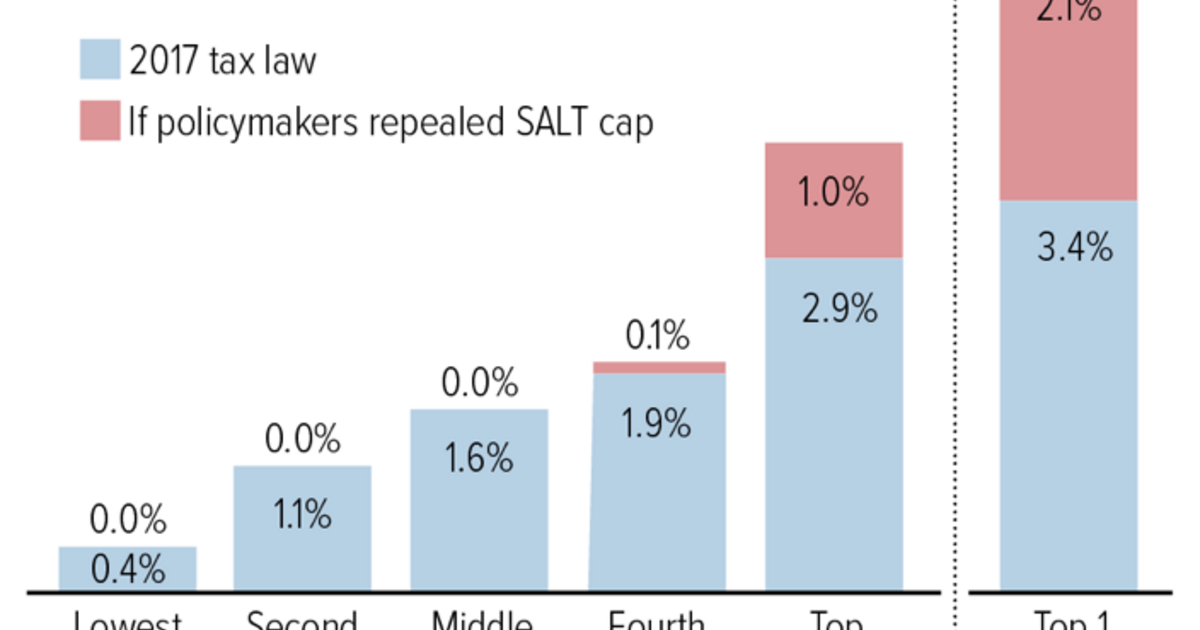

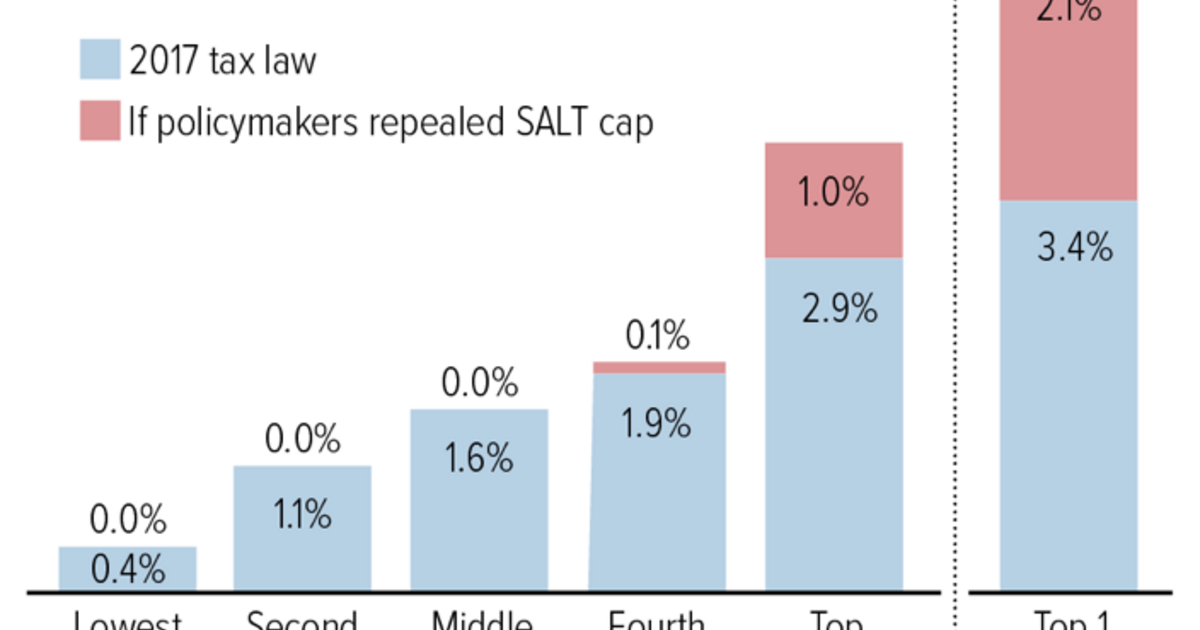

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

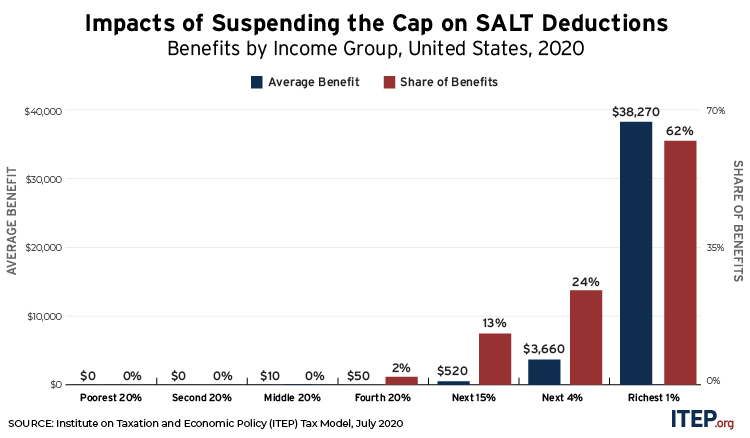

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

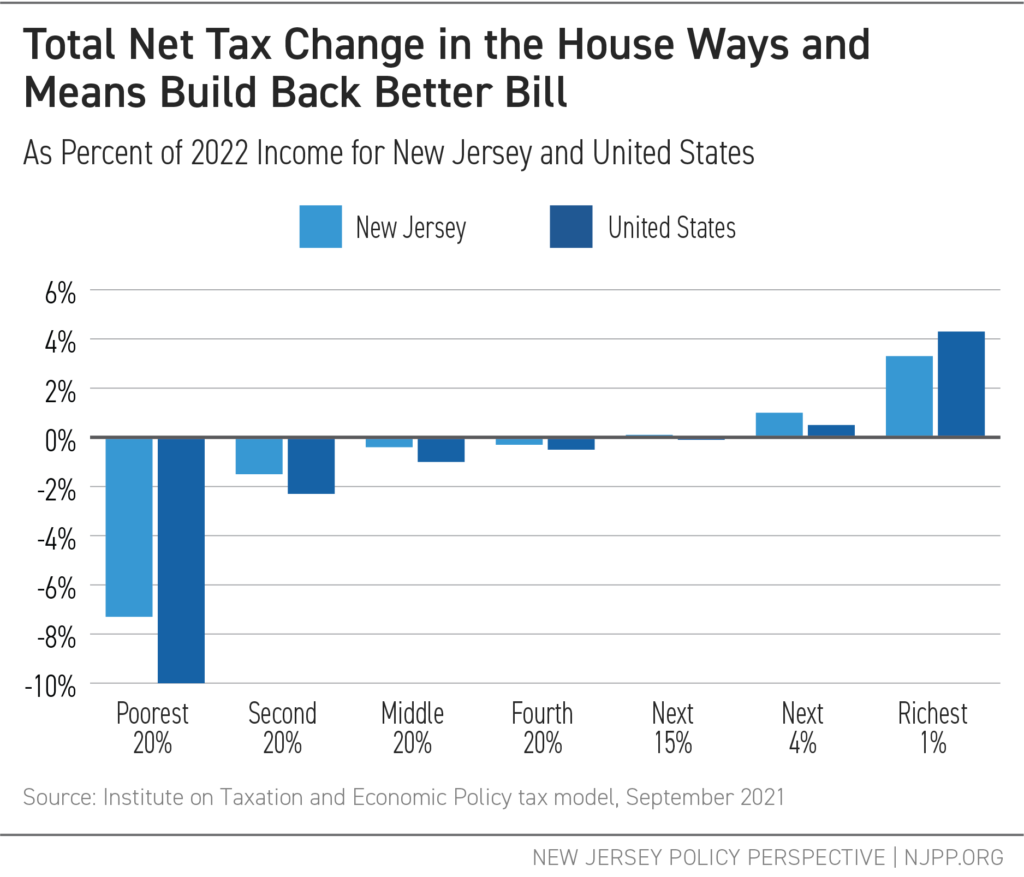

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Cap Repeal Has No Place In Covid 19 Legislation National And State By State Data Itep

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Tpc Impacts Of 2017 Tax Law S Salt Cap And Its Repeal Center On Budget And Policy Priorities